7 years ago

·

by

Donna ·

0 comments

If your home suffers damage in a flood, don’t count on homeowners insurance being enough to protect you. A standard home insurance policy does not cover flooding that originates outside your home, although some types of water damage may be covered. To get coverage against flooding, you will need…

Read more

7 years ago

·

by

Donna ·

0 comments

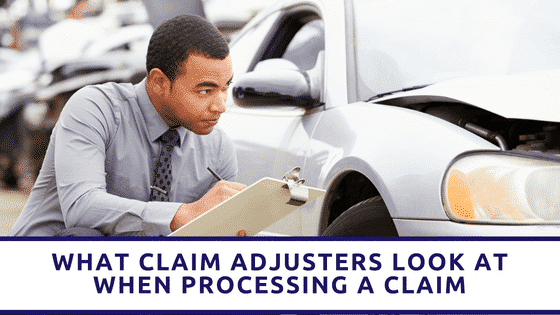

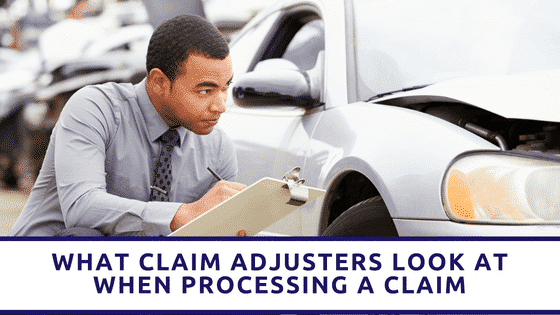

Making a claim against your auto or homeowners insurance will likely trigger a visit from claim adjusters. The adjuster acts as a go-between tasked with the responsibility of gathering information and reporting back to the insurance company for processing. Most adjusters in the modern era don’t have the authority…

Read more