6 years ago

·

by

Donna ·

0 comments

There is a lot of great information about insurance. However, there are also a lot of insurance myths. For example, many people think that they will have to pay more for insurance if they drive a red car. They may also think that their belongings are covered by their…

Read more

6 years ago

·

by

Donna ·

0 comments

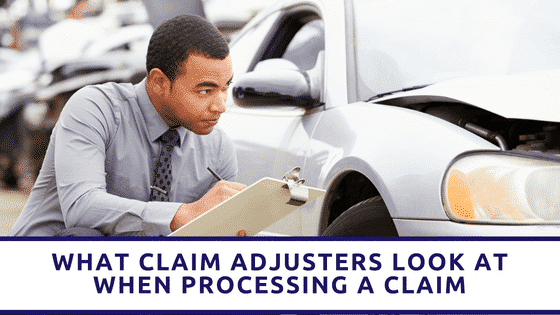

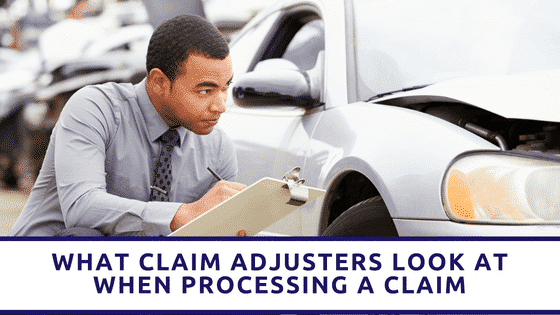

Making a claim against your auto or homeowners insurance will likely trigger a visit from claim adjusters. The adjuster acts as a go-between tasked with the responsibility of gathering information and reporting back to the insurance company for processing. Most adjusters in the modern era don’t have the authority…

Read more